Indian Prime Minister, Mr. Narendra Modi, during the launch of PradhanMantri MUDRA (Micro Units Development and Refinance Agency) Yojana in April 2015 said that supporting the small entrepreneurs of India is the biggest way to help the Indian economy grow and prosper. Stressing the contribution of small entrepreneurs in the economy, the Prime Minister expressed confidence that by 2016, the major banks would also adopt the MUDRA model.

The PM also highlighted the funding problems faced by more than 57 million small businesses across India and how MUDRA aims to reduce borrowing costs of these borrowers as it will provide refinancing at a relatively low 7% rate of interest.

MSME (Micro Small Medium sized Enterprises) sector accounts to approx. 45% of the manufacturing output and 40% of total exports of the country. The labour to capital ratio in MSMEs and the overall growth in the sector is much higher than in the large industries. Thus, MSMEs are important for the national objectives of growth with equity and inclusion.

Yet, these MSMEs face many challenges; mostly financial in nature.

- Many MFI (Microfinance Institutions) started and/or supported by the Government of India (GoI) take 30-60 days to process & disburse loan applications, which is way longer a processing time for MSMEs.

- MSMEs in India usually don’t prefer going to the banks for evident reasons. Even though the Govt. of India guidelines for availing business loans below INR 10 million do not require collateral submission by the applicant, the banks still ask for collateral and guarantors.

The GoI has taken significant initiatives to solve these problems of MSMEs and some of the key initiatives are:

- National Manufacturing Competitiveness Programme (NMCP) – The GoI has announced formulation of National Competitiveness Programme in 2005 with an objective to support the Small and Medium Enterprises (SMEs) in their endeavor to become competitive and adjust the competitive pressure caused by liberalization and moderation of tariff rates.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGFT) – The GoI launched Credit Guarantee Scheme (CGS) to strengthen credit delivery system and facilitate flow of credit to the MSME sector.

- Micro and Small Enterprises – Cluster Development Programme (MSE-CDP) – The Ministry of Micro, Small and Medium Enterprises, Government of India has adopted the cluster development approach as a key strategy for enhancing the productivity, competitiveness and capacity building of MSMEs.

- Small Industries Development Bank of India (SIDBI) - SIDBI, set up on April 2, 1990 under an Act of Indian Parliament, is the Principal Financial Institution for the Promotion, Financing and Development of MSMEs and for coordination of the functions of the institutions engaged in similar activities.

- MUDRA, initially set up as a fund of INR 200 billion, was aimed to refinance credit of MSMEs at a lower the cost of capital.

However, these initiatives too have not been able to substantially address the key challenges faced by MSMEs and the following shortcomings are often witnessed:

- CGFT and SIDBI initiatives were supposed to facilitate loans without the need for collateral/third party guarantees, however the issuing banks still continue to insist for the same for processing loan applications.

- MUDRA initiative is tasked with refinancing MFIs. The model advocating reliance on MFIs has come under scrutiny because these institutions charge exorbitant rates and employ coercive tactics of loan recovery.

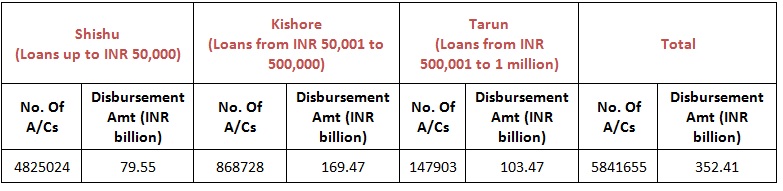

Nonetheless, as on 22nd October 2015, loans worth INR 352.41 billion were disbursed to over 60 lakh MSMEs under MUDRA since its launch in April 2015. During a campaign launched from 01st September 2015 to 02ndOctober 2015 itself loans worth approx. INR 90 billion were disbursed under MUDRA initiative.The disbursed loans fall in three categories: Shishu (up to INR 50,000), Kishore (INR 50,001 to 500,000) and Tarun (INR 500,001 to 1 million).

MUDRA has almost given “a new hope of a better future” to many women entrepreneurs who, without essential education background or work experience, seem to be borrowing money for setting up their own ventures in form of beauty salons, boutiques, eateries and many more, according to Times of India report.

Source: MUDRA

Stay tuned for our next article on SEZs role play in MSMEs’ life today.

4 responses

Great Article on housing loans. Purchasing a new house is always an ultimate achievement. People buy houses which are very new and sometimes an old house that can be renovated later, for such old housed the FHA loan is not going to be sufficient, they provide loan only to buy the house, i.e the registered amount but they consider renovation loan after some time. In this situation I believe Quick Installment Loans without credit would be a good choice, this can be availed very easily and will have plenty of time to repay. This Quick installment loans can be found through loan service providers such as Finfree enterprises who helps people to find hassle-free loans. I have mentioned the link below for more details. Thank you for the wonderful article.

https://loansparadise.com/home-loans.php

Depending on the layout of the house and the wishes of the customer to the design can be used marching, slanting, screw, combined and other types of glass stairs. Floating is a relatively simple type of stairs straight or curved designs, the essential element of which is the presence of the inclined series of steps and connecting them stairs (respectively rectangular or semicircular shape). The most common type of stairway has a slope of 30-45°. In such a ladder, the biomechanics of a person who moves up or down it is taken into account as much as possible. The advantage of the design of the flight stairs-the maximum strength with a minimum number of connections. For attaching stairs to the Bolza is used the same type of hinged plates boltov that is a metal fastener, which is used for sequential mounting steps. Stairs can be straight or winder. This type of ladder design allows you to make the mount almost invisible in connection with what has gained great popularity among designers. But, despite the “visual lightness”, these stairs are able to withstand heavy loads, in particular, in cases where the design of the stairs is enhanced by a combination with a braid, bowstring or wall mount. In terms of design and construction, the combined staircases are characterized by a free spatial configuration, in which the elements of the staircases are combined with various spiral (screw) structures. Most modular and small stairs are also combined. Combined glass stairs-a vivid example of architectural construction in the style of “eclecticism” – the direction in which an arbitrary combination of styles, designs and materials is used. They are original engineering and artistic solutions. To perform such complex work requires the joint work of the architect and designer and, of course, a high level of professionalism of the installation team